I have been reading a lot of articles debating on whether we have a "bubble" or not. After reading the articles, I ignored it and moved on minding my own business. But then I realized, I would not be a good investor if I don't take an opinion on this issue. If I am to be a good investor then I should read the articles, read through the opinion and then decide for my own about what I should do with my hard-earned money.

|

| credit: Denisp12 |

Here's Why The Philippines Economic Miracle is Really A Bubble in Disguise

It is not a Miracle, It is not a bubble

First, let us understand what an "economic bubble" is. As I understand it, economic bubble is used to describe a situation where an economy is growing rapidly and hits a point where everything collapses because the growth was not real but air. You know how a bubble forms in a water then rises rapidly only to pop-out. Same with economics, they coin the term bubble for growth that is not real.

When an analyst predicts a real property bubble, that particular analysts believe that growth is fueled by speculation rather by true demand. Let me try to explain it based on what I know. Real Property developers (those who build offices, condominiums etc), it is assumed, build on a market forecast backed on good research. It means that there is a real demand for offices and houses backed up by purchasing power.

Don't confuse demand with wishes. If you go ask your friends, all will say affirmative if you ask them if they want to have a house of their own. Not surprising because, shelter is one of the basic needs as per Maslow's hierarchy of needs. While all of us dreams of having our own house, not all of us, unfortunately and realistically speaking, can afford it. This is the reason why real estate developers build houses and offices based on real demand and not based on wishes and dreams.

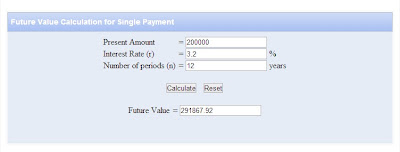

Now, if you look at the prices of offices and condominiums, it would seem that nobody can buy one except for the few rich citizens of our country. And that's the role of banks. Banks offer loans to people who want to buy their own house based on the future potential earning of the individuals. Obtaining a loan is getting money now for the money that you will earn in the future. Again, we don't know what will happen in the future and it is a risk. But banks are in the business of managing risk thus they do credit investigation etc. etc.

With the inclusion of banks in the real estate process, the responsibility of credit check now falls into their hands. Sure, real estate developers still perform market research to estimate how many offices and houses to build. But with the bank's role, these companies now rely on the credit investigation done by banks to see who can really buy one and those who cannot.

The author then shares that according to the World Bank, lending standards have been relaxed, with some local banks raising loan to value ratio of 80 or even 90% in addition to waiving requirements such as proof of income. The proof of income requirement has been waived for many overseas Filipino workers or OFWs who are unable to provide proof of income, yet are able to pay the 20% down payment. There is also evidence that easy-pay mortgages are being offered to home buyers, such as those with zero down payment or low payments in the first few years of loan amortization.

Now, the explanation given for growing middle class and consumer spending boom are the rise of the business process outsourcing sector (read: employment - source of income for Filipinos) and remittances from Overseas Filipino Workers). The author then says that BPO only accounts 4.4% of the country's $250 billion economy. As for the remittances, it accounts for 10.4%. Therefore, the BPO and OFW remittances only accounts for 14.4% of the economy. He further adds that 53% of OFW remittances comes from the US of which majority is from nurses. He adds that these Filipino nurses benefits from the healthcare bubble in the US. If you are reading the news, you know that healthcare is a big ticket item discussed by the US Government. Remember that legal is one of the factors that affects an industry. A negative outcome of the healthcare law may mean losses of jobs for these Filipino nurses. Lost of jobs means lost of remittances. Lost of remittances mean inability to pay back loans.

My Thoughts

It is actually too much information to digest for me. To be honest, I have not changed my stock investments. So I guess, while I have not verbally decided on this issue, my action of not changing my investments mean I am taking the side that there is no property bubble. As my professor said, we are always making decisions whether we make one or not. Not making a decision is also a decision.

One thing bothers me though. Ayala Land and BPI are part of Ayala Group. SMPH/SMDC and BDO are under the same group. These companies posted positive earnings in the past few years. These companies both earn in the property value chain process. I just hope credit checks are really done as they should for new property loans.

Also, who should I believe in. The 28 year old Jesse Colombo or John Mangun who has 25 year experience in the Philippine Market. Again, age should not matter. Then i recall certain CNN Journalist who goes by the name Anderson Cooper criticized by a local news anchor by saying he (Anderson) does not know what he is saying while she is confined in the air conditioned room far away from the devastation area.