From Evernote: |

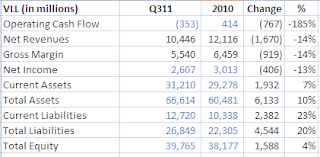

Review of Property Firms - Q311 Results |

Disclaimer: Please do your own due diligence when making decisions :)

Revenues

Sales is the starting point of all so let's start our review on this number. SMDC posted the highest increase in revenues compared to other companies reporting a 24% increase. MEG reported a small increase at 1%. I guess this is due to the fact that SMDC serves middle and lower income market. I interpret this as that there's a big market in middle and lower income group. It is important that revenues are increase because this means that the company is reporting growth. But i would like to caution that revenues is just a component. The gross margin plus operating expenses also comes into play for th profitability of a company.

In terms of revenues in absolute peso, MEG still has the highest reported number

Gross Margin

MEG has the highest reported gross margin ratio followed by FLI. SMDC is trailing at 40.74%

Profit Margin on Sales

This number shows the amount of centavo a company converts to profit for each peso of revenue. MEG is still the company to beat at 32.44%. This means there's a 32 centavos for each P1 the company bills their customer. FLI follows at 28.34%. This is still a good number but the decreasing revenues of FLI worries me. It might be biased since we are only working with three quarters worth of revenue but comparing it with MEG and SMDC, these two companies were still able to increase their revenues.

Return on Assets/Equity

Among the four companies, MEG still leads the competition by reporting the highest number of ROA/ROE followed closely by SMDC.

Summary

MEG is still the company to choose given its high profit margin on sales, ROA/ROE and positive cash flows. The company is a safe bet among the four. If one is to take a higher risk, SMDC looks promising with its increasing revenues. However, the company has to improve its operations to increase its profit margin on sales. Again, SMDC is talking a different territory so this is really promising. I particularly like SMDC because it is serving a different market thus it kinda has the first mover advantage for the market segment. (That reminds me, i should use forces of competition in next analysis).

If you want to the details of each company please see here