This is part three of Personal Finance series where I share guides to get you started on personal finance. If you haven't, read Day 1: Setting Financial Goals and Day 2: Knowing Your Net Worth before proceeding with the post below

|

| Copyright Damian Gadal |

Welcome Back!

I am glad you are still with me in this five day personal finance course.

We are done setting financial goals and knowing our net worth. The next step is dive deeper in our cash or income flow

But first, allow me to step back a little bit. How did it feel knowing your net worth?

I am glad you are still with me in this five day personal finance course.

We are done setting financial goals and knowing our net worth. The next step is dive deeper in our cash or income flow

But first, allow me to step back a little bit. How did it feel knowing your net worth?

When I first did this exercise, I was shocked and surprised!

I never knew before that I only have that much. I thought it will be higher because I was earning this much on an annual basis. However, my annual income is totally far from my net

worth. Where could all those money have gone? I think my wife had the same surprise when did computed for her net worth.

Shocking may it be for some us, at least we have made progress. Knowing where we stand will enable us to move forward.

Shocking may it be for some us, at least we have made progress. Knowing where we stand will enable us to move forward.

Understand Your Income Flow

List down your day to day expenses so we get an estimate of how much you spend and how much you really need. The objective of this exercise is to know if you are operating in a net loss or profit.

Your typical expense will include the following

- Home/Rent – includes mortgage, lease, rent

- Utilities – Includes payment for your electricity, gas/heating, telephone, cellphone, internet, cable, water and garbage

- Groceries – your expenses for groceries, dine-outs for breakfast, lunch and/or dinner. If you spend for coffee include it here.

- Entertainment – Will include your purchases for movie tickets, mp3s (if you pay and not download illegally. Please stop music piracy J )

- Car/Auto – include here your expenses for transportation. Taxi fare, jeepney fare, MRT, Gasoline for your car, parking fees, car wash

- Insurance Medical – If you pay for your insurance on an annual or quarterly basis, compute for the monthly amount. Say if you pay P24,000 for your insurance, then dividing it by 12 will give you a monthly cost of P2,000.

- Departmental – This is where I group expenses for clothes, personal items, books, magazines, appliances

- Miscellaneous – are those out of the blue expenses and one time expenses that is not part of the first categories. One time purchases like that one night spent paying for a hotel.

Then same with the exercise we did with the assets and liabilities, add up your expenses.

Next step is to do the income part. List down all your sources of income. If you are an

employee like me, you are receiving salary from your employer. Write it down. Add all other

source of income if any.

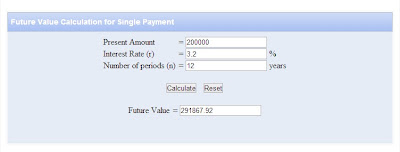

Now, deduct your assets from your liabilities. The goal is we should be earning more than we are spending. The excess earnings are then to be added in our assets to increase our net worth.

So there, you will now know if you are living within, above or below your means.

Ideally, you should be generating positive income and not occurring losses.

If you are, I suggest you find ways to increase your income.

If you can’t then time to review those expense and cut those unnecessary ones.

We haven’t reach the third day but it is critical that you aim for a positive

net worth and positive cash flow.

Tomorrow is tying it up together: Preparing a Budget