Five Day Personal Finance Course FREE

|

| Copyright Bradipo |

The reason I wanted to do this is that in my search for personal finance knowledge, I seldom come across a step by step guide. Most of the time, what I read are advice and tips to follows. Advice like be frugal, don’t buy this and that. While helpful, these advice were not able to help me out.

After pouring myself reading books and blogs, I decided to write about the steps that I have taken based on the learning I picked up.

Why five days? Because personal finance bores most people (even me at times). I thought if you read five posts in my blog everyday and do the tasks for the day, somehow, you will be able to learn and apply it .

So if you know anyone who might find the series of posts useful, let them know by sharing the link to mysite. Also, if you haven’t subscribed to my posts yet, I suggest you do so you do not miss out posts.

Alright, after so much introduction, I welcome you to Day 1 of Personal Finance Course. Over the next five days, I will be posting topics that will help you get started managing your finances.

Before we start some key rules

1. Do the tasks!

2. Do the tasks!

3. Do the tasks!

Yes. Three simple rules.

Just don’t go reading the posts but I expect you to grab some pen and paper or use Microsoft Excel, or Microsoft Word. If you want, you can even blog it. If you have a planner or a notebook, use that so you can always go back to your answers to the tasks and review them. You can also print the financial goals worksheet available here.

First Step: Goal Setting

Do you want to be rich? Really? How much do you need for you to say you are already rich? P10M, P20M or P30M or more than that?

Tell me a ballpark figure.

And when you have that money, what are you going to do? You

are going to buy a house? What house? Where? How much? How many bedrooms? How

many garage?

Oh you also want a car? How many? What make? What color? How

much do you need to get them?

You see, it is not enough to say you want to be rich. Rich

is a word that has different meaning to everyone. One will define it as owning

this and that and another will define it differently. So if you want to be rich, please define it by setting specific and doable goals.

How to Set Goals

- Identify your financial goals

- Estimate the cost and Set a Target Date

- Determine how much you need to save

Setting goals is the first step in turning the invisible

into the visible - Tony Robbins, author of Awaken the Giant Within

|

| Copyright AG Gilmore |

Identify your financial goals

For this particular step, let your imagination run wild.

If you say you want to be rich, then this is the time to create your own and specific definition of what rich is. If owning two cars is being rich with you then write it down. Own two cars. If having a house in Forbes Park is your dream, then write it down. Own a house in Forbes.

If you say you want to be rich, then this is the time to create your own and specific definition of what rich is. If owning two cars is being rich with you then write it down. Own two cars. If having a house in Forbes Park is your dream, then write it down. Own a house in Forbes.

Whatever it is you want to have, write it down.

If you are hindered by the thought at the back of your head

saying these goals will never be accomplished, ignore that voice for now.

Really. Ignore that voice and dream big.

Estimate the cost and set a target date

Now, go back to your list and put some monetary value to

that dream.

An example, for me, one of my dream is to visit Paris in

2025. A trip today will cost me around P100,000 per person. I am planning to

bring my wife so that is roughly P200,000.

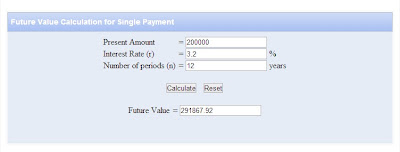

Determine how much you need to save

In 2012, the published average inflation rate was 3.2%.

Well, this is really low but using this number as basis, then by 2025 I will

need the amount of P200,000 inflation rate adjusted.

Present Amount: P200,000

Interest Rate: 3.2% (I am assuming this as the required

rate based on the assumption that prices of tickets, hotel will increase by

3.2%)

Number of Periods

= 12 years. (Estimate)

Then I computed for the future value using this website

So why do we have to go the trouble of estimating the cost

and setting the target date? Because this will help us identify how much to

save and where to put our money.

In my example, since my plan is to visit Paris in 2025 and

not now, then my goal should be to save money regularly so that I will have the

amount of P291,867 by 2025.

If I already have P200,000 now, do I still need to place my

money somewhere? Yes. Because if I just leave my money in a savings account or

just hold the money, by the time I need it in 2025, I only have P200,000 and

will still have to shell out additional P91,867.

Can I just go now? In theory I can because I have the budget

but spending that amount is something I considered luxurious with the current

income that I have and the current expenses that I pay. I have set a longer timeline

because I know by that time, I am earning more and my kids are grown up by that

time that I and my wife can leave them with my parents without really worrying

that much.

The key thing here is know your goals then set aside money

and place it in an instrument that will give you the expected amount by the

time you need it.

If you need the money five years from now, then go save your

money in a five year instrument.

If you need the money three months from now, then do not put

in instruments such as bonds and stocks. Put them in short term instrument such

as savings deposit or time deposit.Quick Summary

- Identify your financial goals

- Estimate the cost and Set a Target Date

- Determine how much you need to save

Tomorrow, will talk about net worth.

If you have not subscribed yet, do sign-up above or bookmark this page. Also, if you know someone who might need to do this, send him/her the link. Better yet, make him a partner as you do the tasks. This way you will be accountable to someone. You can help each other.

Till then